Introducing The EU Asset Registry: Precursor to Confiscation of Citizen Assets?

It's all for 'transparency'. It's to 'protect' you. It's to 'fight' tax evasion. Honest. Multiple sources cited, tips on how to protect yourself, and further recommended reading and viewing resources.

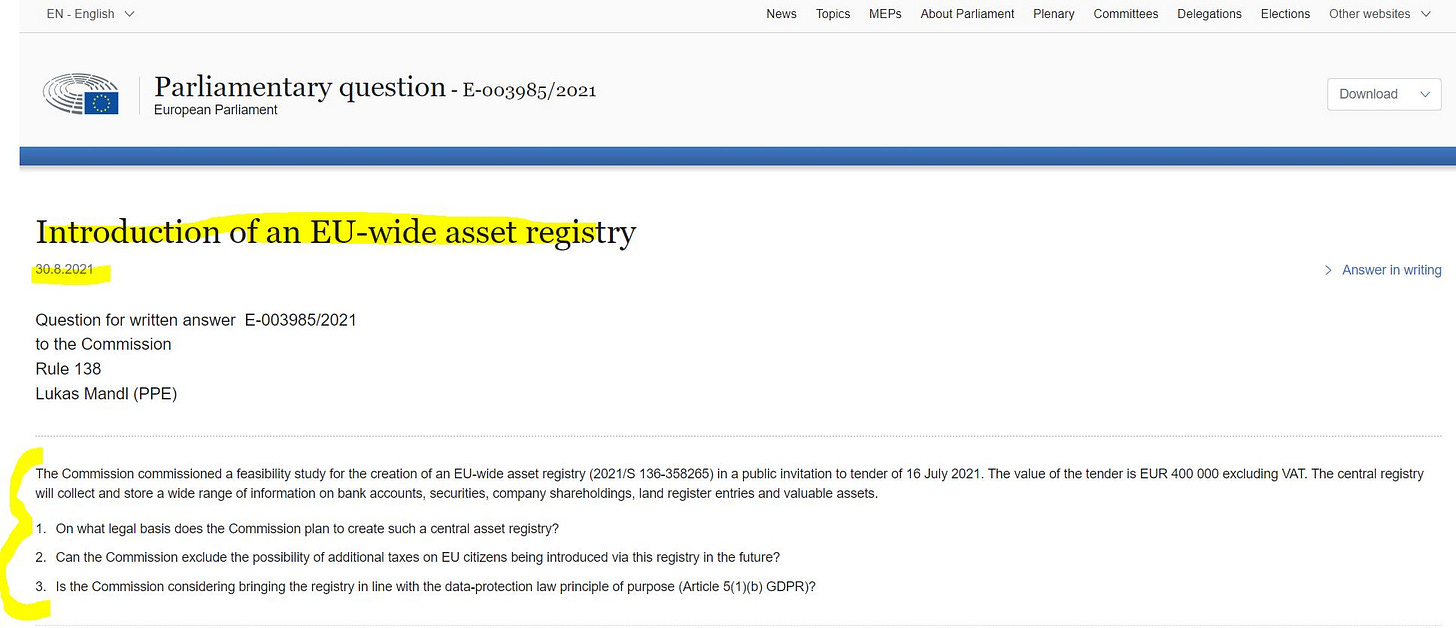

This story from 2021 is circling the wagons once again, perhaps owing to the rumour mill of the EU (via the European Commission) edging closer to finalising their controversial ‘asset register’. There are no updates I could find directly from the proverbial horse’s mouth. Here is a blurb from the EU site in 2021 when it was put forth in their ‘parliamentary session’ - for which the plebs did not have a look in:

The Commission commissioned a feasibility study for the creation of an EU-wide asset registry (2021/S 136-358265) in a public invitation to tender of 16 July 2021. The value of the tender is EUR 400 000 excluding VAT. The central registry will collect and store a wide range of information on bank accounts, securities, company shareholdings, land register entries and valuable assets.

1 .On what legal basis does the Commission plan to create such a central asset registry?

2. Can the Commission exclude the possibility of additional taxes on EU citizens being introduced via this registry in the future?

3. Is the Commission considering bringing the registry in line with the data-protection law principle of purpose (Article 5(1)(b) GDPR)?

The feasibility study relating to an EU asset registry is being carried out as a result of a specific request from the European Parliament for a ‘Pilot Project — Feasibility Study for a European asset registry in the context of the fight against money laundering (AML) and tax evasion’ in the context of the EU budget for 2020[1]. In response to that request, the Commission issued a call for tender on 16 July 2021. Such a study, undertaken at the request of the European Parliament, will not prejudge possible future policy initiatives by the European Commission, which would remain subject to Better Regulation principles, in particular the requirement to carry out a comprehensive impact assessment.

The question of financing would be included in any possible impact assessment.

The purpose of the study is to assess the feasibility of the project from all perspectives, including operational and legal aspects, in particular the protection of fundamental rights and personal data. The terms of reference clearly highlight that any potential option for the design and functionality of an EU asset register needs to factor in the above legal requirements, and in particular compliance with the EU General Data Protection Regulation[2].

[1] See Working document on Pilot projects and Preparatory actions in budget 2020 and 2021, https://www.europarl.europa.eu/doceo/document/BUDG-DT-648406_EN.pdf

Brussels Report published an article on 30th August 2021, which cited the tender for the contract, providing this link - although the tender has been completed and I could not find details to corroborate these claims:

The tender specifies to “aim at exploring how to collect and link information available from various sources on asset ownership (e.g. land registries, company registers, trusts and foundations registers, central depositories of securities ownership, etc.) and analyse the design, scope, and challenges for such [an EU] asset registry.”

With regards to which assets would be registered, the document, published in July, notes:

“The possibility to include in the registry data related to the ownership of other assets such as cryptocurrencies, works of art, real estate, and gold, shall also be considered.”

Is the EU broke? In their zeal to collate a massive centralised (blockchain based?) database of all assets owned by EU citizens, my mind immediately goes to three places:

These types of actions usually precede asset confiscation and capital controls. This could be triggered through real or fabricated ‘tax evasion’ cases.

Seizure of citizens’ assets could be used to bail in the central banks.

If the centralised database ends up on a blockchain, it ties in nicely with Blackrock’s quest to tokenise ‘real world assets’ - turning every asset on earth into a tradable commodity.

[See links at end of article to explore these points].

The Germans quoted in the Brussels Report article were already sounding the alarm in 2021:

Die Welt notes that “it would make the ownership of real estate, gold or bitcoins retrievable”, quoting German CSU MEP Markus Ferber that the European Commission hereby “once again completely exceeds what should be within its tasks”.

– Germany’s liberal party FDP stated that “to fight crime does not justify turning EU citizens into glass objects.” Other politicians shared the outcry.

– In a leader, Kronen Zeitung, Austria’s most popular newspaper, describes the EU as a “fanatic spy of our assets”. It recalls Austria’s own failed experience with a wealth tax and an asset register, mentioning it was “abolished, because it was insanely difficult to record the relevant items and the income it delivered was smaller than its cost.”

– Another Austria daily, Die Presse, notes that “it reads like a Chapter of Orwell’s 1984”.

– German magazine Focus carries the headline “the EU wants to search us until the last cent”, furthermore warning:

“If this register would come to fruition, the consequences are obvious. For example, for politically unpleasant citizens – which does not only include criminals – it become much more difficult to pursue their activities in the future. These could be investigative journalists or whistleblowers, for example, that are threatened with more targeted reprisals.”

Heed their words.

More recently, published on 7th May 2024 by Deutsches-Edelsteinhau:

Something is brewing in Brussels that many are not aware of. Parliament and the Commission have decided to monitor all assets of European citizens and to take action against the migration of wealth. To register all this, the AMLA (Anti Money Laundering Authority) was recently established. And we have to ask ourselves whether this is really about fighting money laundering or rather about fighting our financial freedom? What should we prepare for and which crisis investments can secure our assets?

The planned EU asset register is primarily about an EU-wide central beneficial ownership register plus an associated central account and safe deposit box register as well as central access to national real estate registers. This comprehensive surveillance raises the question: are we heading towards an EU-wide wealth tax or a burden-sharing system? The interference with our financial freedom continues to take concrete form.

In 2023 it was officially announced that the AMLA will have its headquarters in Frankfurt am Main. She is expected to start work in mid-2025 and will lead a team of over 400 employees.

What should this authority record?

Luxury goods: All purchases of luxury cars, yachts and works of art must be registered. Luxury retailers must record the identity of their buyers and present it upon request.

Investments and beneficial ownership: All investments and the associated beneficial ownership must be disclosed.

Bank accounts and safe deposit boxes: All accounts and safe deposit boxes must be recorded.

Real Estate: All real estate holdings must be disclosed.

Vehicle registration: Vehicles are also subject to registration.

Financial data: This includes all account information, mortgages, collateral and electronic payments.

Personal data: Citizenship, registration, social security data, financial data, tax data and customs information are collected.

In addition, it is proposed to limit cash transactions above a certain amount. This measure is intended to help make money laundering more difficult.

Yikes. Big brother is watching, surveilling, and soon to be registering all our worldly possessions on a giant database. Governments throughout Europe are also massively indebted from all the quantitative easing (money printing) to infinity from the last decade ++. They “borrowed from the future”. Perhaps the can may no longer be kicked down the road? What a nightmare.

How can you protect yourself?

This is not financial advice, but intended to be educational and informative…Always do your own research!

If you hold cryptocurrency in a self-custodial wallet - i.e. a ‘hot wallet’ with a seedphrase or a physical device ‘cold / hardware wallet’ with a seedphrase, your crypto cannot be ‘seized’ by the government - so long as you break up the seedphrase into a few pieces, store it in multiple locations, and perhaps have some of the phrase stored in your head only - as a ‘brain password’.

“Not your keys, not your coins.”

For an introduction to all crypto-related terminology and links to further resources to learn more, check out this piece I wrote in 2022:

Tagging on one more piece of information for crypto - for the especially paranoid and privacy orientated, you may consider holding some Monero (XMR) crypto - as a digital privacy coin, it cannot be traced back to you, unlike Bitcoin which is on a transparent public ledger - with some effort, organisations can usually match wallet addresses to individuals, unmasking their identities. Monero is becoming harder to buy, because governments are pressuring crypto exchanges to de-list it, citing criminals using it, money laundering, yada yada, the usual ‘justifications’. Here are two exchanges where Monero can be bought:

https://www.kraken.com/en-us/sign-in

Kraken is a large exchange, although becoming more restricted for US and EU citizens as I understand from friends who have had problems sending FIAT currency from their bank accounts to the exchange.

Trade Ogre is a small exchange with no KYC (‘know your customer’) meaning no selfies, no passport scanning, etc. All you need is an email address to create an account and away you go. However, it has no fiat on-ramp, meaning you cannot connect your bank account or make debit / credit card payments…Therefore, you would need to buy something like Bitcoin or Litecoin from another exchange, then send it to your Trade Ogre account wallet address, then swap it for Monero.

Most self-custodial wallets for Monero come with the dual option of having a ‘keystore’ file with a password to access your crypto, as well as a 12-word seedphrase. It could be prudent to have the seed phrase as a ‘brain password’ only…

If and when you or I are eventually rounded up for a stint in the Gulag - stripped of all our real world assets - at least we could cling onto our memorised Monero brain passwords until we get out or escape.

You could also elect to hold gold in a (safer?) tax haven destination such as Singapore, within a bullion bank vault, to circumvent the EU asset registry disclosure rulings, and avoid potential confiscation. Hopefully.

Alternatively, you could store physical gold in a safe, a self-storage locker, or bury it somewhere ‘X’ marks the spot in your memory.

Of course, the mantra of the gold-bugs is:

“If you don’t hold it you don’t own it”

Yet, if you find yourself between a rock, a hole, and a looming EU asset registry database, maybe it’s worth rolling the dice by outsourcing the storage of your bullion within another country’s jurisdiction.

Here are two bullion banks in Singapore, for which you can buy and sell gold and silver using cryptocurrency or FIAT currency. Just make sure you do your own research and understand the difference between ‘spread’ and ‘no spread’ before you buy.

Bullionstar has a great blog that often tracks gold purchases by central banks for all governments around the world - as much as can be tracked owing to transparency of purchases made.

Bullionvault has market vaults in other countries, but you can choose to store your bullion in Singapore if preferable.

Stay sane, stay strong, stay sovereign.

Further recommended reading and viewing

Nicholas Creed is a Bangkok based writer. All content is free for all readers, with nothing locked in archive that requires a paid subscription. Any support is greatly appreciated. If you are in a position to donate a virtual coffee or crypto, it would mean the world of difference.

Bitcoin address:

bc1p0eujhumczzeh06t40fn9lz6n6z72c5zrcy0are25dhwk7kew8hwq2tmyqj

Solana address:

Ds6QpUxaWB6bJ8WF4KAazbuV25ZhPRdZh4q4BXutj4Ec

Ethereum address:

0x42A7FA91766a46D42b13d5a56dC5B01c153F1177

Monero address:

86nUmkrzChrCS4v5j6g3dtWy6RZAAazfCPsC8QLt7cEndNhMpouzabBXFvhTVFH3u3UsA1yTCkDvwRyGQNnK74Q2AoJs6

The US requires everyone to disclose their entire holdings of digital money on their annual tax forms. It's been that way for the past couple of years. I found it very intrusive and creepy. It's not even income yet, simply an asset, but they require you to tell them about it.

I wonder what they will do about Bill Gates?

GAVI Alliance assets are exempt from any form of requisition, confiscation or expropriation or any form of foreclosure, other government enforcement measures. Credits, income, assets are exempt from all taxes and fees.