UK Uniconomy: Universal Basic Income and Bail-Ins

Labour proposes changing the definition of a working person to "someone who relies on public services and does not have savings." This sounds ominous.

The election selection cycle is a funny old game. Vote harder. This time it will be different. We promise. Clean house. Change the faces so that people do not associate the newly installed government with the global governance structure unveiled in lockstep marched coordination, during the COVID scamdemic era and the identical ‘response’ of almost all governments worldwide. Which of course created the controlled demolition of the economy along with the C19 injection (and midazolam) induced democide, which is ongoing. Without painstakingly going through the manifestos of the Conservative party and the Labour party point-by-point, we will focus on universal basic income proposals. This ties in with the definition of what constitutes a so called ‘working person’ - set to be changed by the Labour party - assuming the stage is set and rigged for them to get in and puppeteer the helm at 10 Downing Street. More on that later.

Whilst scanning Labour’s manifesto, the word ‘working’ appears no less than 52 times, surprisingly, there is no explicit mention of the definition of a working person - which has cropped up in the MSM on the back of Keir Starmer’s ambiguously guarded words.

Grabbing this via Sky News:

Asked what he meant by working people, Sir Keir told LBC on Tuesday: "People who earn their living, rely on our [public] services and don't really have the ability to write a cheque when they get into trouble."

Ms Reeves was asked to clarify that position, telling Sky News' Breakfast with Kay Burley on Wednesday: "Working people are people who go out to work and work for their incomes.

"Sort of by definition, really, working people are those people who go out and work and earn their money through hard work."

[…]

Asked if that also meant people who cannot write a cheque if they get into trouble, she said: "Some people, who go out to work haven't been able to build up savings.

From The Telegraph (non pay walled archive link):

Sir Keir Starmer has suggested that millions of Britons are not covered by his manifesto pledge to “not increase taxes on working people”.

The Labour leader said he would define working people as those who have a job, rely on public services and do not have meaningful savings.

Savers

Sir Keir’s comments suggest anybody with meaningful savings is not considered a “working person” who should be protected from tax rises.

That indicates up to two-thirds of working households are not covered by the pledge, according to a Resolution Foundation report from February.

It found there are 11 million working-age people who have less than £1,000 in savings, which is considered the minimum required as a “rainy day” fund.

Fewer than half of working-age households in the United Kingdom had savings which were worth at least three months of income, the researchers found.

This seems to imply that people with savings could be subject to bail-ins, if / when the economy gets into even direr straits.

BAIL IN LEGISLATION

According to Investopedia, a bail-in can be summarised as follows:

Bail-ins and bailouts are designed to prevent the complete collapse of a failing bank. The difference between the two lies primarily in who bears the financial burden of rescuing the bank.

[…]

European Bail-In Policy

The use of bail-ins was evident in Cyprus, a country saddled with high debt and the potential for bank failures. The country's banking industry grew after Cyprus joined the European Union (EU) and the Eurozone. This growth, coupled with risky investments in the Greek market and risky loans from two large domestic lenders, led to government intervention in 2013.7

A bailout wasn't possible, as the federal government didn't have access to global financial markets or loans. Instead, it instituted the bail-in policy, forcing depositors with more than 100,000 euros to write off a portion of their holdings, a levy of 47.5%.8

In 2013, the EU introduced resolutions to make the bail-in a common principle by 2016 in response to the effects of the European Sovereign Debt Crisis. It transferred the responsibility of a failing banking system from taxpayers to unsecured creditors and bondholders, the same way Dodd-Frank did in the United States.

What Are the Risks of a Bank Bail-In on Consumers?

Bail-ins allow banks to avoid bankruptcy by shifting some risks to their creditors rather than to taxpayers. This risk can be transferred to bank customers, too.

The bottom line here is that people with savings, could wake up one day with a haircut taken off their bank account balances - which will assuredly be ginned up as #WeAreInThisTogether invoking the #GreaterGood ethos we have all come to know and love fear and loathe.

I can already hear the British readers tutting, saying that the UK is no longer subject to the European Union European Commercial Bank Bail-in legislation, since the UK ‘left’ the EU following Brexit.

Right you are. However, the UK government has since stealthily passed its own version of bail-in legislation.

Enter stage left - The Bank Recovery and Resolution Directive (2017) for the UK is contained within the UK's Financial Services (Banking Resolution and Miscellaneous Provisions) (No. 2) Act 2016. This legislation was enacted to ‘transpose’ the EU Bank Recovery and Resolution Directive (BRRD) into UK law.

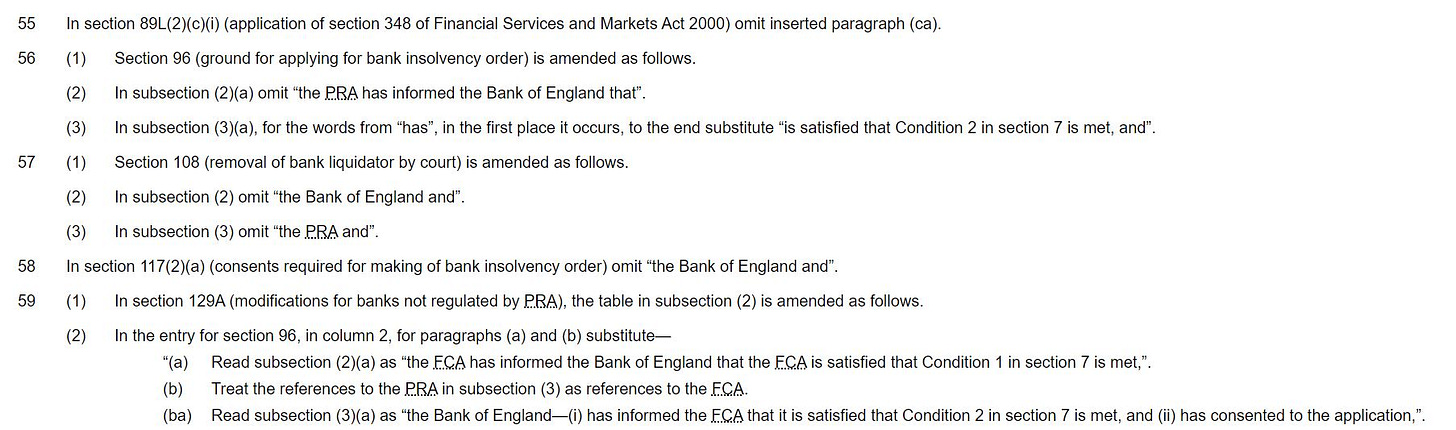

Section 55 of the Act specifies the criteria for the bail-in tool, which allows the resolution authority (currently the Bank of England's Prudential Regulation Authority) to write down or convert certain types of bank liabilities into shares or other capital instruments to recapitalise the bank.

We can read slightly less convoluted language from the Bank Of England’s website:

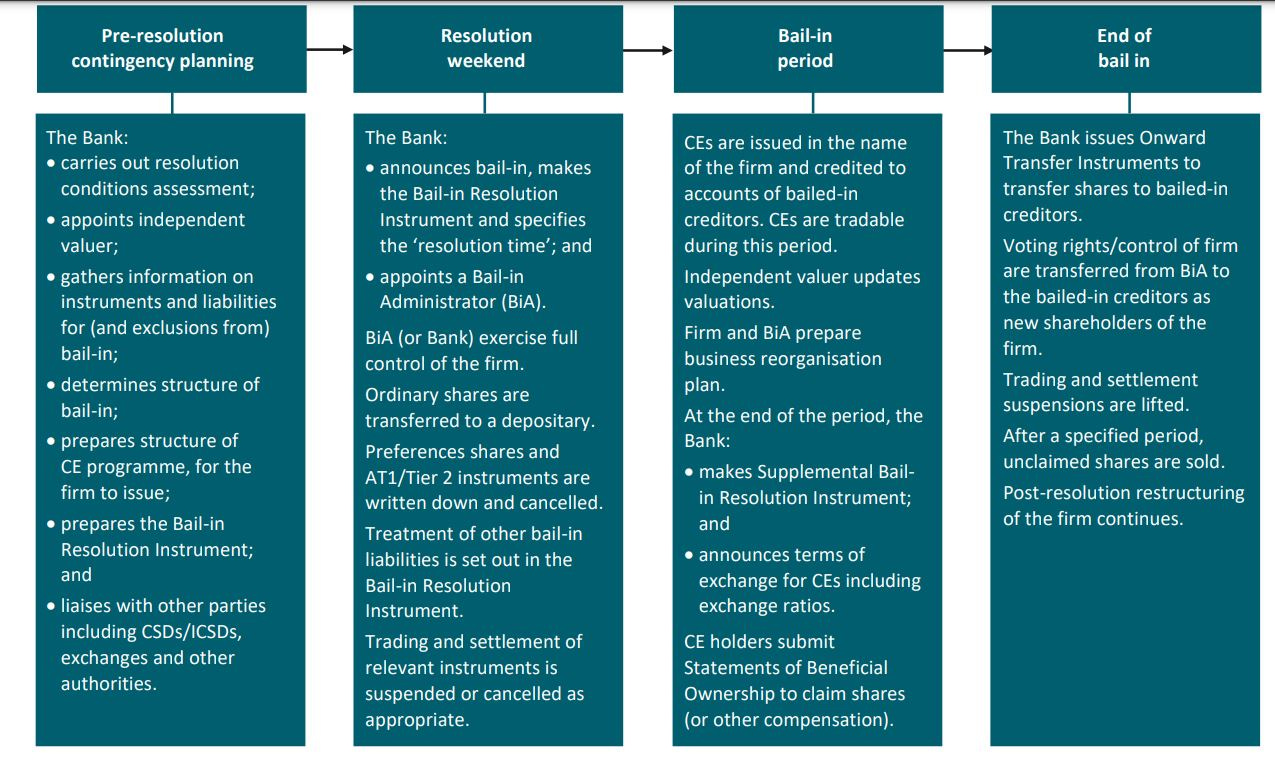

Bail-in is one of the stabilisation tools available to the Bank as resolution authority under the Banking Act 2009. Bail-in ensures investors, rather than public funds, bear losses where a firm fails.

[…]

In practice, a bail-in is likely to be a highly complex transaction involving multiple parties. This document is intended to increase awareness and understanding of the actions that may take place in a bail-in resolution in the United Kingdom.

In light of the fact that bail-in is a crisis management tool, the Bank reserves its full discretion to depart from the approach in the operational guide and Template Resolution Instruments should it be judged appropriate in the circumstances of a particular case.

Ergo, in whatever is deemed to be the right type of ‘crisis’, whether it is engineered, or opportunistically seized upon to “never let a good crisis go to waste”, the stage is then set for the banking system to legally take funds from their customers’ accounts, in order to keep the banks solvent.

How might all this play out? Hypothetically:

A National emergency is declared on the back of [insert your crisis here]

Similar draconian government ‘intervention’ to the ‘COVID response’ leads to mass business closures and people asked to “shelter in place” or “stay home”

Bail-ins are invoked

Universal Basic Income (UBI) is ushered in for anyone ‘without savings’ left unemployed and destitute

Central Bank Digital Currencies become nigh irresistible for the masses, with strings attached for compliance as good citizens, in order to receive their monthly CBDC token stipend, as part of the UBI.

UNIVERSAL BASIC INCOME

Within the UK’s Conservative party manifesto, the words ‘universal credit’ appear as follows:

The Conservative party’s manifesto:

Uniparty? Uniconomy?

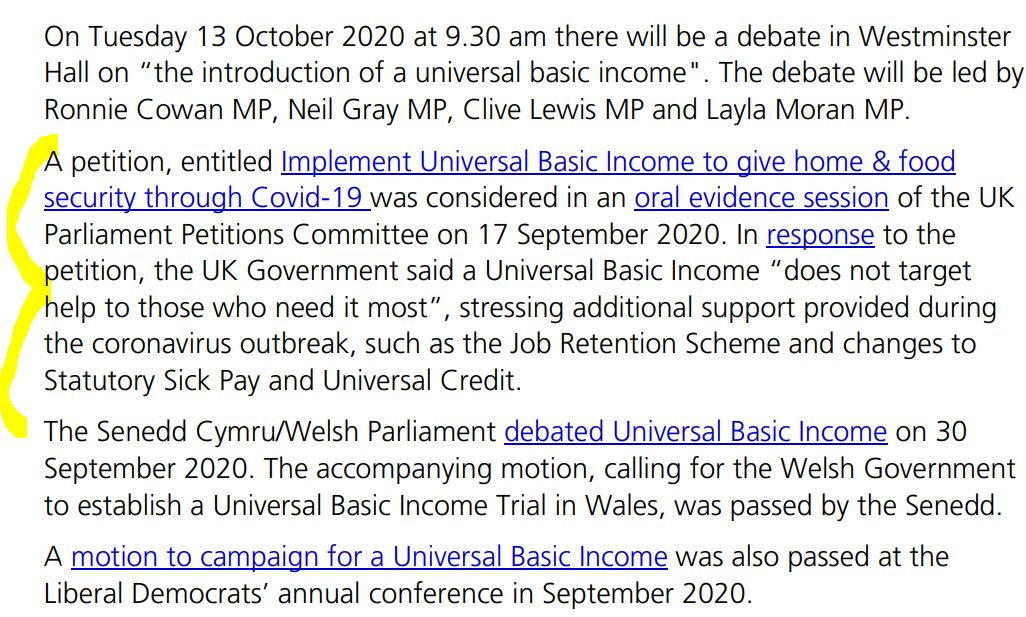

Let’s take a peek at when UBI was debated in the House of Commons in October, 2020.

UBI has already been trialed in Wales:

Wales has been trialing a Universal Basic Income (UBI) scheme, providing a fixed amount of money to individuals, regardless of their employment status or income. The scheme aims to give people financial security and stability, allowing them to cover the basic cost of living.

The Welsh government has launched a UBI pilot scheme, providing £1,600 per month (before tax) for two years to over 500 people leaving care in Wales.

The scheme is designed to support young people transitioning to adult life, providing financial stability and security.

The pilot will run until May 2025, with a final evaluation expected in 2027.

The scheme has received positive feedback from participants, with a provisional uptake rate of 97%, surpassing that of any other opt-in UBI scheme globally.

To fully appreciate how sinisterly UBI could tie in with CBDCs, I highly recommend watching this superb video from the Coin Bureau YouTube channel, which also suggests what you can do to preserve your wealth (via crypto and gold and being a part of like-minded communities):

UK ELECTION CONSERVATIVE PARTY PLEDGES

Kit Knightly, writing for OffGuardian, mused over Rishi Sunak’s pledge for the Conservative party to bring back National Service, and how that makes the Labour party the likely favourite to win the election on 4th July - almost by design:

One particular campaign promise has already caused a huge stir, with incumbent PM Rishi Sunak pledging to re-introduce National Service – mandatory military or some other community service – should the Conservatives win.

It’s caused a huge backlash already, with memes and videos circulating on social media either mocking or protesting the plan.

Not even the usual Tory defenders in the media have come to the governments aid, with defense of the policy relegated to joke hate-figures like Stanley Johnson.

Even the UK military is said to be “divided” over support for the scheme, with one ex-military Chief supposedly calling it “bonkers”.

…and despite this backlash, the Tories have doubled down. Claiming that children and parents could face fines and criminal prosecution for refusing to participate.

So, will the Tories really do it?

Almost certainly not. For two reasons.

1) They don’t really want to.

2) They won’t have the opportunity.This is simply confirmation that the powers-that-be have already decided Labour will almost certainly “win” the “election” in July.

[…]

So let’s be clear: No, they’re almost certainly not going to introduce National Service.

I doubt they have either the desire or intention to do so. National Service is a topic introduced to the national political discussion because it’s so unpopular, because it sells an agenda, because it almost certainly opens the door for an emphatic Labour victory and because it sets up a secondary bait-and-switch “solution” down the line.

This article tackled some complex topics, and I welcome any corrections and / or relevant links to additional sources that the reader thinks could add greater context or clearer meaning in weaving together UBI, Bail-ins, CBDCs, and the UK election.

Nicholas Creed is a Bangkok based writer. All content is free for all readers, with nothing locked in archive that requires a paid subscription. Any support is greatly appreciated. If you are in a position to donate a virtual coffee or crypto, it would mean the world of difference.

Bitcoin address:

bc1p0eujhumczzeh06t40fn9lz6n6z72c5zrcy0are25dhwk7kew8hwq2tmyqj

Monero address:

86nUmkrzChrCS4v5j6g3dtWy6RZAAazfCPsC8QLt7cEndNhMpouzabBXFvhTVFH3u3UsA1yTCkDvwRyGQNnK74Q2AoJs6

Almost everyone knows that Labour will win the election with a large majority. Almost everyone also knows that the incoming regime will be an appalling disaster.

That's a pretty gloomy state of affairs, politically and otherwise, for the UK.

Wow. "None of you are ends in yourselves. Each of you is the means to others' ends. You have no right to exist for your own sake. You are both cannibal and feast." I can think of a couple of objections to that moral depravity, and none of them have anything to do with how much money it will cost. Unfortunately they'll get away with it, because most people don't mind being dined on as long as they get to hold a fork once in a while themselves.