Digital Pound: UK CBDC 'Consultation'

Technocratic digital prison draws closer. Exploring CBDC rollout and solutions to opt out.

HM Treasury and Bank of England consider plans for a digital pound.

Published on 7th February 2023 on the UK government website.

the Treasury and the Bank of England are consulting on a potential digital pound, or central bank digital currency (CBDC)

a digital pound would be issued by the Bank of England and could be used by households and businesses for everyday payments in-store and online

if introduced a digital pound would be interchangeable with cash and bank deposits, complementing cash

no decision has been taken at this stage to introduce a digital currency

The Bank of England will now take forward further research and development work and the public are being invited to give their views on the scheme to be taken forward.

Whether or not anything derailing to the proposed scheme comes out of the results of respondents to this consultation remains to be seen. Click here to access the document acting as a foreword for the consultation. Click the screenshot below to access the link whereby the HM Treasury invites views on the questions posed in the consultation paper. The deadlines for responses will be 7th June 2023.

Let us delve into this into the consultation paper and its ramifications.

The paper cites cash payments declining and card use accelerating, as shown in the above chart.

The foreword introduces the document as follows:

Banknotes, issued by the Bank of England, are being used less frequently by households and businesses. New technologies are allowing for the emergence of new forms of digital money, and new ways and devices to pay with it. International developments have the potential to affect the UK domestically and as a global leader in finance.

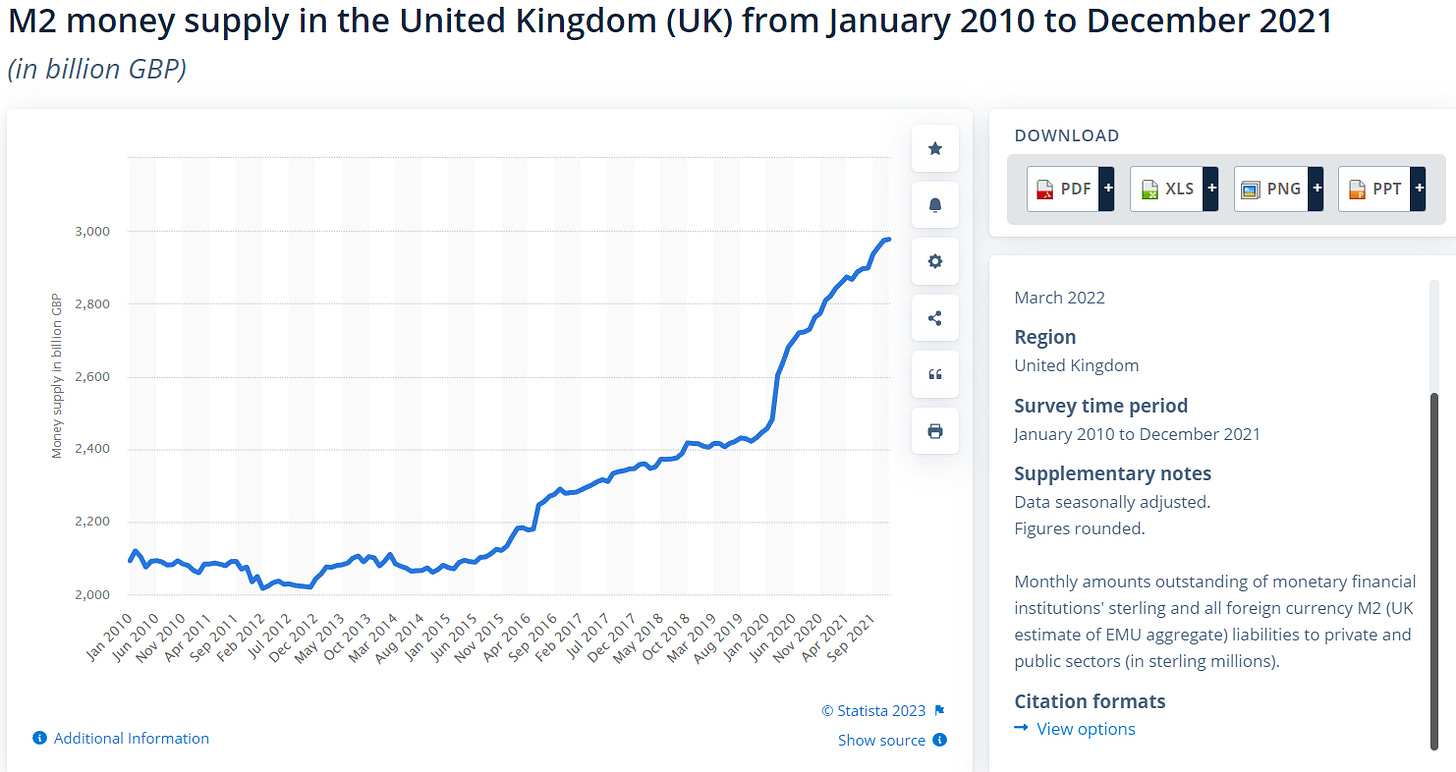

As a sidebar, separate from the aforementioned paper, we should also understand the M2 money supply in the United Kingdom.

The velocity of money measures the number of times that the average unit of currency is used to purchase goods and services within a given time period. The concept relates the size of economic activity to a given money supply, and the speed of money exchange is one of the variables that determine inflation. The measure of the velocity of money is usually the ratio of the gross national product (GNP) to a country's money supply.

If the velocity of money is increasing, then transactions are occurring between individuals more frequently. The velocity of money changes over time and is influenced by a variety of factors.

Because of the nature of financial transactions, the velocity of money cannot be determined empirically.

The above graph is taken from statista.com for context, showing the M2 money supply in the UK from 2010 to 2021.

The UKs M2 money supply reached nearly three trillion GBP by the end of 2021 an increase of more than 100 billion GBP throughout the past year. The "intermediate money" is the sum of M1 (currency in circulation and overnight deposits), deposits with maturity of maximum two years and deposits redeemable at notice of maximum three months.

M2 money supply could be much more meticulously tracked in a cashless society, allowing government ‘intervention’ to program the CBDC tokens to expire whenever they wish to ‘boost’ spending or dissuade saving.

The consultation paper claims that (for now) cash will be preserved in the UK:

Cash, of course, remains vital for many. Around 1.2 million UK adults do not have a bank account and around one fifth of people name cash as their preferred payment method. Cash remains important to a large cross-section of society. Even those who do not use it regularly consider it an important back up form of payment. For those reasons, UK authorities are committed to ensuring continued access to cash. Measures to protect retail access to cash, and the supporting wholesale distribution services, are being introduced in the Financial Services and Markets Bill. But while we ensure continued access to cash, we also have to recognise that it cannot be used in digital transactions, which are becoming an increasingly important part of daily life.

A particularly insightful infographic can be found on page 50 of the document:

I have highlighted the left-side text ‘The Bank of England and the Government would not see any personal data’. Ask yourselves, what real or orchestrated event would it take for this ‘unseen’ personal data to be overridden? In the event of widespread fraud committed by an individual or organisation, or perhaps because you went to the ‘wrong’ kind of protest, donating to protesters or event organisers.

Would such eventualities be seized upon by the government and ‘justified’ to give them carte blanche in tracing transactions back to individuals, examining all their personal data, and subsequently locking them out of the financial system?

Just like the Canadian government tyrants Justin Trudeau and Chrystia Freeland did to people during the trucker protests in Canada - freezing bank accounts of both protesters and those who donated to them - then families found their mortgage payments failing to go through. Those families had no legal recourse, because the actions were taken by the totalitarian government, for the benefit of crushing dissent and sending a strong message to anyone wishing to stand up against tyranny.

The text highlighted on the right-side of the infographic ‘Limited amount per user, at least initially’ is both deceptive and alarming. It insinuates that the limit per user will only be initial, because of the nature of introducing a new monetary system. Yet, elsewhere we can see this reported on by Reuters in more detail:

Britain's government said on Monday that it and the BoE were pressing on with work on a possible digital pound that was likely to enter circulation in the second half of this decade and be held in a "wallet" provided by banks, although no final decision has been made.

"We propose a limit of between 10,000 pounds and 20,000 pounds per individual as the appropriate balance between managing risks and supporting wide usability of the digital pound," Cunliffe said in a speech.

It seems relevant at this point of the misdirection to invoke a quote by Milton Friedman and Rose D. Friedman, writing in Tyranny of the Status Quo:

Each recession has produced government spending programs supposedly as a temporary device to create jobs. But nothing is so permanent as a temporary government program. Those programs have typically moved into high gear only after the economy was on the road to recovery. In the process, they have established an interested constituency that has lobbied for their continuation, thereby contributing to the upward trend in government spending.

The last three years have shown us throughout the world and so called ‘democracies’, how governments have demonstrated an unwillingness and often times an outright refusal to relinquish ‘emergency powers’, by extending decrees endlessly, abusing the power granted to them (by themselves, undemocratically), in the spirit of ‘public health’.

Why should we trust them to do right by us if when they turn off the printing press cash spigot? We would effectively become slaves to the whimsical and tyrannical nature of governments leading us to serfdom, would we not?

A UK parliament publication from 13th January 2022, teases us with the ‘security risks’, eluding to the distributed ledger technology to be utilised for the CBDC:

There are two main security risks posed by a CBDC. First, individual accounts could be compromised through weaknesses in cyber security. Second, the centralised CBDC ledger, which would be a critical piece of national infrastructure, could be a target for attack from hostile state and non-state actors. While no design can guarantee absolute security, any CBDC system will need to be adaptable to emerging security threats and technological change, including fast-developing quantum computing.

The CBDC is by nature and name centralised. Ergo, the antonym of decentralised. We, the plebs, shall not be able to view the code as opensource, nor will we be able to access the entirety of the distributed ledger, albeit the retail or the wholesale version. This should give major cause for concern - for security, for sovereignty, and for freedom. Freedom to spend our money how, where, when, and on what goods and services we choose to.

The case for a digital pound may change in the future and therefore the Government and Bank of England could derive most benefit now by taking action to shape global standards which suit the UK’s values and interests, for example with regard to privacy, security and operational standards.

Naturally, the UK government wishes to exert their ‘soft power’ by leading and shaping global policy, to become a cookie cutter for the CBDC model to be rolled out, replicated, and released throughout Europe and the rest of the world.

If you have been paying attention to the developments of the CBDC dystopian nightmare that awaits us, you may have already connected the dots, imminently inbound as a full frontal assault:

CBDC will be linked to a digital ID

Digital ID already piloted by the Covid-19 ‘vaccine’ passports

CBDC will inevitably be linked to a social credit score

End result means that having a low social credit score and / or being ‘unvaccinated’ would see you unable to partake in everyday society

Unable to travel, unable to buy / sell; ostracised and cast out of mainstream mediums of exchange, indefinitely.

I would back up these unthinkable claims by drawing upon a key citation from the G20 Bali Leader’s Declaration, Indonesia, 15-16 November 2022 (page 8, paragraph 23):

We acknowledge the importance of shared technical standards and verification methods, under the framework of the IHR (2005), to facilitate seamless international travel, interoperability, and recognizing digital solutions and non-digital solutions, including proof of vaccinations. We support continued international dialogue and collaboration on the establishment of trusted global digital health networks as part of the efforts to strengthen prevention and response to future pandemics, that should capitalize and build on the success of the existing standards and digital COVID-19 certificates.

This is not going away. We are not going back to normal. Our would be overlords are only just getting warmed up.

Let us briefly hear comments on the difference between cash and CBDCs, in terms of traceability, from Agustin Carsens, General Manager of our ‘friends’ at the Bank of International Settlements, during a discussion hosted by the International Monetary Fund (IMF). Timestamp 24:17 - 24:58.

We tend to establish the equivalence with cash. There is a huge difference there. In cash, for example, we don’t know who’s using a one hundred dollar bill today, who is using a one thousand peso bill today. A key difference with a CBDC is that the central bank will have absolute control on the rules and regulations that we determine the use of that expression of that central bank liability. Also, we will have the technology to enforce that.

Let that sink in.

We will wrap up by providing the readers with some tools on how to track the progress of CBDCs in any given region, as well as pointing to solutions, and how to opt-out of the system.

A tool from another of our ‘friends’ at the Atlantic Council is useful in determining how far along a CBDC is in your locale. The CBDC tracker:

Each tab can be filtered, giving definitions on status, architecture, underlying technology, use case, cross-border projects, and technology partnerships. Here are the definitions taken from each tab (apologies for small text, zoom in on this page to view more easily):

I have written about CBDCs before, providing solutions and recommended reading to other well researched alternatives here:

More recently, I would direct readers to the excellent work by James Corbett in explaining the CBDC systems, drawing upon many valuable resources, and the CBDC opt out challenge:

This article involved reading multiple documents, collating and sourcing relevant material, as well as discarding other documents without enough substance.

If you found value in this piece, consider pledging a paid subscription. I intend to turn on paid subscriptions in April this year, to mark the one year anniversary of this Substack.

*All content shall remain free, and anyone pledging a paid subscription would not receive any special benefit; it would be purely optional, and out of kindness.

Nicholas Creed is a Bangkok-based journalistic dissident. If you liked this content and wish to support the work, buy him a coffee or consider a crypto donation:

BTC: 39CbWqWXYzqXshzNbosbtBDf1YoJfhsr45

XMR:86nUmkrzChrCS4v5j6g3dtWy6RZAAazfCPsC8QLt7cEndNhMpouzabBXFvhTVFH3u3UsA1yTCkDvwRyGQNnK74Q2AoJs6Pt

.