Carbon Tax Dystopia

Exploring carbon tax and green washing initiatives throughout ASEAN, the investors, the players, and how governments intend to move from 'voluntary' adherence to 'mandatory compliance'.

The inspiration to dive into this topic for South East Asia / ASEAN came from the outstanding work done by Whitney Webb and Mark Goodwin at Unlimited Hangout. Specifically from their article entitled Debt From Above - which covered carbon credits, the financialistion of nature itself, and a smart system surveillable grid of nature’s resources throughout the Latin Americas, employing satellite technology and distributed ledger tozenisation technology.

NATURE’S RESOURCES AS AN ASSET CLASS

The financialisation of nature's resources as an asset class in South East Asia has several manifestations, including carbon credits, green bonds, and other initiatives that promote so called “sustainable development and environmental conservation.” Within the altruistic trappings of tapping into humanity’s desire to “save the planet” and for the perpetual quest to attain “the greater good” mythos, this dystopian road paved with green gold, is nothing short of a giant Ponzi scheme. It is a system of tyrannical control over (complicit) corporations and (unwilling?) citizens, whom shall be herded into a system of carbon tax, carbon credits, lifestyle choice curtailment, and ultimately, deprivation and despair.

Whitney Webb and Mark Goodwin wrote:

In a 2023 article, Lockton’s head of Digital Integration and Special Projects, David Briscoe, wrote that making carbon credits “a stable and trusted currency” would “require the support of the insurance market.” This is because, as Briscoe notes, “voluntary” carbon markets come with risks, particularly because “of the financial values involved.” Per Briscoe, these risks include “non- or under-delivery of forward purchased carbon removal credits,” “start-ups involved in the voluntary carbon market may face insolvency risks,” and “fraud and negligence.” Indeed, mismanagement and fraud has been a major driver of why carbon markets have failed to catch on despite relentless promotion and the adoption of ESG and climate change plans by many of the most powerful names in finance and industry. Instead of addressing the rampant fraud in carbon credits directly, it appears that the high probability of fraud and insolvency has been seen as an opportunity to create a new market for the insurance industry, with carbon credit insurance being framed as the only “feasible” means of de-risking the fraud-prone world of carbon markets, which have been criticized by environmental groups and have been shown to have a negligible impact on climate.

The Association of Southeast Asian Nations (ASEAN) has been exploring the creation of a regional carbon market to facilitate the trading of carbon credits among member states. This initiative aims claim to reduce greenhouse gas emissions, promote sustainable development, and generate revenue for participating countries. The ASEAN Carbon Market would allow companies to purchase carbon credits from other companies within the region, incentivizing the reduction of greenhouse gas emissions and promoting the use of renewable energy sources.

Your researcher’s position on the “need to reduce greenhouse emissions” is that this is a complete fabrication and an inversion of the truth. CO2 is a life giving gas. I recommend reading my synopsis of this documentary, an absolute must see:

Climate: The Movie (The Cold Truth) is Excellent

This documentary is very well made. Whenever revelatory or self-evident truths about prevailing official narratives begin to make the lies collapse in on themselves, we always see the cultists-du-jour cornered like dangerous animals, ready to lash out for one last stand…Climate lockdowns could be right around the corner - perhaps the final

The REDD+ (Reducing Emissions from Deforestation and Forest Degradation) program is an international initiative that aims to reduce emissions from deforestation and forest degradation by providing financial incentives to countries that implement sustainable forest management practices. ASEAN countries have been researched under a report based on ‘investment priority mapping’.

Designed to map and assess social forestry programs and business models, our use of se.plan aids in delineating investment-worthy areas within the social forestry landscape. Its geospatial analysis considers biogeophysical aspects, market infrastructure proximity, and accessibility to market intermediaries, aligning with the initiative's goal of identifying priority areas for social forestry investment in some ASEAN countries. Results provide actionable insights to help guide the sustainable commercialization and scaling up of social forestry-based enterprises in the region.

The report concludes, especially for Cambodia, that:

These maps are a significant step in prioritizing areas in these countries where investment, coupled with careful land use planning and the right supporting policies, can help secure economic benefits for communities and restoration of trees—likely with ecosystem conservation and climate change mitigation and adaptation benefits.

The Biodiversity Credit Mechanism is an initiative promoted by the ASEAN Biodiversity Outlook (ABO) 2020 to incentivise the conservation and sustainable use of biological resources. This mechanism aims to provide financial incentives to companies and individuals that invest in conservation and sustainable use of biological resources, such as forests, wetlands, and marine ecosystems. Companies would be encouraged to purchase credits from projects that promote the conservation of biological resources, such as reforestation, habitat restoration, and sustainable fishing practices.

Several South East Asian countries have launched green bond initiatives to promote “sustainable development and finance environmentally friendly projects.”

These schemes are derived from the master framework set out by the ASEAN Green Bonds Standard, an initiative being led by the ASEAN Capital Markets Forum. In their own words:

The ASEAN Capital Markets Forum (ACMF) is a high-level grouping of capital market regulators from all 10 ASEAN jurisdictions, namely Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

Established in 2004 under the auspices of the ASEAN Finance Ministers, the primary responsibility of the ACMF is to develop a deep, liquid and integrated regional capital market.

Recognising the differing levels of development of member states, ACMF adopts a pragmatic approach in implementing its capital market initiatives whereby member countries opt-in to join the initiatives based on their market readiness.

The ACMF meets twice a year, and is currently chaired by Lao Securities Commission Office/LSCO.

ACMF Action Plan 2021-2025

Using the feedback from the survey and engagements, ACMF identified three Strategic Objectives for AP 2021-2025, which are (i) Fostering Growth and Recovery with Sustainability; (ii) Promoting and Sustaining Inclusiveness; and (iii) Strengthening and Maintaining Orderliness and Resilience.

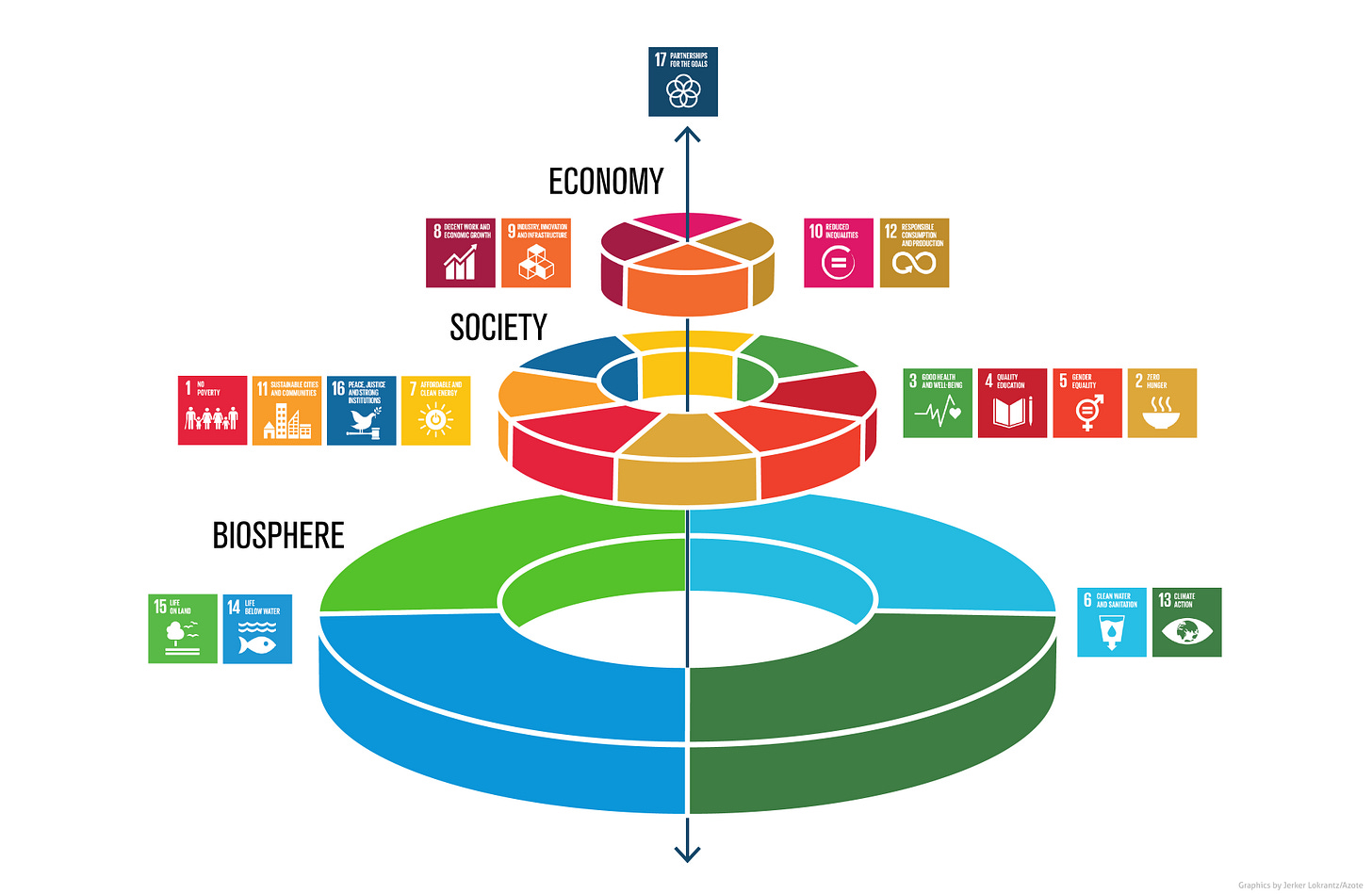

Note that the last paragraph ties in neatly with the UN Agenda 2030 sustainable development goal (SDG) 9 - fostering growth and recovery with sustainability by promoting innovation and infrastructure development.

CLIMATE CHANGE COOPERATION IN SOUTH EAST ASIA

The Asian Development Bank (ADB) is promoting regional cooperation on climate change and disaster risk reduction.

The ADB details its strategies as follows:

Expanding the use of clean and renewable energy

Encouraging sustainable urban development and transport

Promoting climate-resilient development

Strengthening policies, governance, and capacities

Managing land use and forests for carbon sequestration

As ever, the tyranny of words are being hijacked by the organisations, inverting the true meaning of the language, hidden behind the benevolent sounding lexicon. The people of SEA will be harmed by the low-carbon craze adding multiple layers of regulation for tracking carbon emissions, forced upon manufacturers producing goods from steel industries to food and beverage - the costs will be passed onto the consumer, leading to higher prices for goods and services. This will likely lead to more factories closing down, resulting in greater unemployment, and more dependence on the state. More on this later when we delve into Thailand’s current economic situation, its mass factory closures, and the carbon tax coming into play in 2025.

While those driving these initiatives may feign to have positive intentions, such as promoting sustainable development, they also risk exacerbating inequality and perpetuating a system of debt and financialisation.

It is worth pointing out that the intensive mining for mineral deposits and lithium, required to produce renewable tech and solar panels is extremely damaging to the environment. As summarised by James Corbett:

We are constantly warned that so-called "fossil fuels" are the harbingers of the Apocalypse and that we must switch to an all-renewable power grid or face the wrath of the weather gods. . . . But we are not told that there are not enough known mineral deposits on the planet to make even one generation of renewable tech units, or that the process for mining the lithium required for the lithium-ion batteries in this hypothetical renewable energy grid is itself wreaking untold havoc on the environment, or that the solar panels touted by the renewable energy advocates are a ticking environmental time bomb of difficult-to-dispose toxic waste, or indeed that the "green" energy myth is a scam propounded by the oligarchs who wish to keep the masses from making use of the abundant energy resources that have lifted the human race out of poverty.

THAILAND’S CARBON TAX

The climate agenda based articles have been ramping up in frequency and preachiness lately within the mainstream media. Environmental, Social, and Governance (ESG) puff pieces are guilting more business leaders to get with the program. Carbon taxes have been announced yet not finalised for 2025 with the Climate Change Bill. All the while, the Thai government is pressuring the central bank to cut rates, household debt to GDP levels are surging, factory closures are increasingly commonplace, exports are down, and the foreign income tax law threatens to create a mass exodus of wealthy individuals and corporate foreign investment.

Let us take a look at some of the recent announcements.

A government pledge to cut a large amount of greenhouse gas emissions is expected to reshape how Thai businesses operate.

Authorities are pushing ahead with Thailand's first climate change bill, aimed at achieving carbon neutrality and net-zero targets, which were announced by the Prayut Chan-o-cha government at the UN Climate Change Conference in Glasgow in 2021.

Vowing to strike a balance between carbon dioxide emissions and absorption by 2050, along with a balance between greenhouse gas emissions and absorption by 2065, the government needs to enforce rules requiring businesses to take stronger actions to reduce their carbon footprint.

Thailand is drafting a climate change bill, with a plan to impose a carbon tax on manufacturers.

The new bill, slated to be forwarded to the cabinet for approval in the third quarter, makes it mandatory for entrepreneurs to add environmental measures to their business processes, including monitoring and reporting the amount of greenhouse gases they release as well as paying a new tax based on carbon dioxide emissions.

The bill also promotes the use of funds and loans to assist entrepreneurism transitioning to eco-friendly practices.

CARBON TAX

Pornchai Thiraveja, director-general of the Fiscal Policy Office (FPO), said the climate change bill plans to impose a carbon tax on manufacturers.

The bill stipulates the collection of a carbon tax on goods based on the assessed amount of greenhouse gases in a product's life cycle.

Initially the flood of comments calling out the climate alarmism scam was notable immediately. This screenshot was taken at 11am on the day the article was published:

Multiple comments - with the majority pointing out the climate scam - were completely scrubbed by the moderators by the evening of 10th June. A few people called out The Bangkok Post for purging these comments, with other suspect newly created profiles promoting the climate agenda. Although it is telling that those who are pro-climate cultism are downvoted:

A week later we had this gem:

Thailand's first climate change bill is prompting businesses to step up efforts to fight global warming, with a recent project co-developed by Chevron Thailand and Prince of Songkla University aiming to cut carbon dioxide emissions for rubber plantations.

The new law, which is scheduled to be forwarded for the cabinet's approval by the third quarter of this year, imposes a tax on carbon dioxide released from business operations and requires entrepreneurs to collect data on greenhouse gas emissions and report it to the Office of Natural Resources and Environmental Policy and Planning.

Chevron and Prince of Songkla University united to work with two rubber farmer cooperatives -- Ban Sai Khao and Yung Thong -- in Songkhla province to use their rubber plantations for a carbon dioxide reduction.

The process to make rubber sheets at Yung Thong rubber farm cooperative in Songkhla. Waste water from rubber smoking can be used to make biogas by environmental projects, including clean energy development and environmentally friendly businesses. The credits can be sold to other companies to off set the carbon dioxide they release into the air.

Thailand announced in 2021 plans to be more aggressive in addressing climate change, striving to reach carbon neutrality, a balance between carbon dioxide emissions and absorption, by 2050, along with a net-zero target, a balance between greenhouse gas emissions and absorption, by 2065.

The climate change bill is another eff ort to cut carbon dioxide through legal measures.

To achieve the net-zero goal is an uphill task, requiring the business sector to make "considerable changes to every manufacturing process", which requires assistance from R&D projects, he said.

One of Thailand’s major banks - Kasikorn - has unveiled its new climate strategy, offering loans and support for ‘green businesses’, whilst hinting at non-desirable industries and businesses being punished or having funds withheld to support their growth:

Strategy 1: Green Operation

– Propelled by its commitment to reducing GHG emissions from operations (Scope 1 & 2) to Net Zero per global standards, KBank has redesigned its operational processes, starting with the development of a GHG database system and carbon credit-related operations beginning in 2012. KBank has gained experience through implementation that has been evidenced by concrete results, including solar rooftop installation at all seven main buildings. In addition, solar rooftops are to be installed at 78 branch offices within June 2024. Meanwhile, 183 internal-combustion engine (ICE) vehicles in KBank’s fleet have already been replaced with electric vehicles.

Positive impacts: KBank has been able to continually reduce its GHGemissions, as seen from the decrease of 12.74 percent realised in 2023compared to the base year of 2020, while carbon credit management hasbeen undertaken for six consecutive years (2018 – 2023), with the aim ofbecoming Net Zero in its Scope 1 & 2 by 2030.

Green Finance to assist customers

Strategy 2: Green Finance

– KBank has leveraged its comprehensivestrengths in loans and investment in supporting the business sector’stransition, including: 1) Green Loans and Transition Finance; 2) Investmentallocation to businesses and startups that create positive impacts; and 3)Offering of investment products of KBank and its global partners to attractinvestment funds to support ESG businesses. In 2022-2023, KBank’sfinancing and investment for sustainability totalled 73,397 million Baht. Thatfigure is estimated to reach 100 billion Baht and 200 billion Baht within 2024and 2030, respectively, in accordance with the established plan.

Positive impacts: The key performance indicator (KPI) under this strategy isportfolio emissions of key industries, for which the Bank attaches importanceto control and support their transition to Net Zero. Given this, the Bank hasimplemented the Sector Decarbonization Strategy for five industries, namely:power generation, upstream oil & natural gas, thermal coal mining, cement,and aluminium. Several measurable signs of progress have been found,including the portfolio of the power generation industry, for which KBankoffers green loans totalling 3.8 billion Baht. The Bank’s Emission Intensity perGWh in this portfolio declined by 5 percent in 2023 compared to thebaseline year (2020), which is in line with the established plan.

Integration of capabilities and delivery of solutions beyond banking

Mr. Pipit added, “The Bank's overall greenhouse gas emissions largely comefrom its financed portfolio, accounting for approximately 480 times theemissions from the Bank’s own operations – Scope 1 & 2. Therefore, the Bankhas adjusted its strategy and accelerated the development of tools to support greenhouse gas emissions reduction for entrepreneurs in line with the government’s efforts and views towards supporting the business sector in this matter. Additionally, businesses that must make environmental adjustments require support from KBank beyond financial assistance, such as ESG knowledge, technical consulting services, and business matching among ESG groups. KBank has thus integrated capabilities – including solutions, knowledge, and technology – to elevate both its own operations and those of its clients through a strategy aimed at delivering services beyond financial solutions.”

Strategy 3: Climate Solutions

– Comprehensive environmental solutions with cooperation from partners to offer knowledge provider solutions delivering advisory and useful information for business transition as well as reduction solutions for consumers and business initiated through various pilot projects, such as the WATT’S UP platform that offers comprehensive electric motorbike rental services, and battery swapping services through designated service points. Presently, there are 367 active users

[...]

Strategy 4: Carbon Ecosystem

– The Bank is ready to connect with the carbon ecosystem to further develop services in carbon credit-related transactions. This involves studying and purchasing carbon credits to offset the carbon emissions of KBank and other companies within KASIKORNBANKFINANCIAL CONGLOMERATE, selecting reputable projects and supporting high-quality carbon credits. The focus is to serve as a role model and contribute to the growth and acceptance of Thailand’s carbon credit market on a global scale. To this end, KBank has partnered with INNOPOWER Co.,Ltd. (INNOPOWER) in launching a platform for Renewable Energy Certificate (REC) registration and sale to facilitate individuals and small and medium-sized businesses that have installed solar rooftops to register and sell RECs. Additionally, the Bank has explored other elements of the carbon ecosystem, such as carbon credit broker/dealer and carbon credit tokenization..

We can see how all the aforementioned points correlate with the ASEAN Green Bonds market and the tokenisation of carbon credits, detailed earlier in this piece.

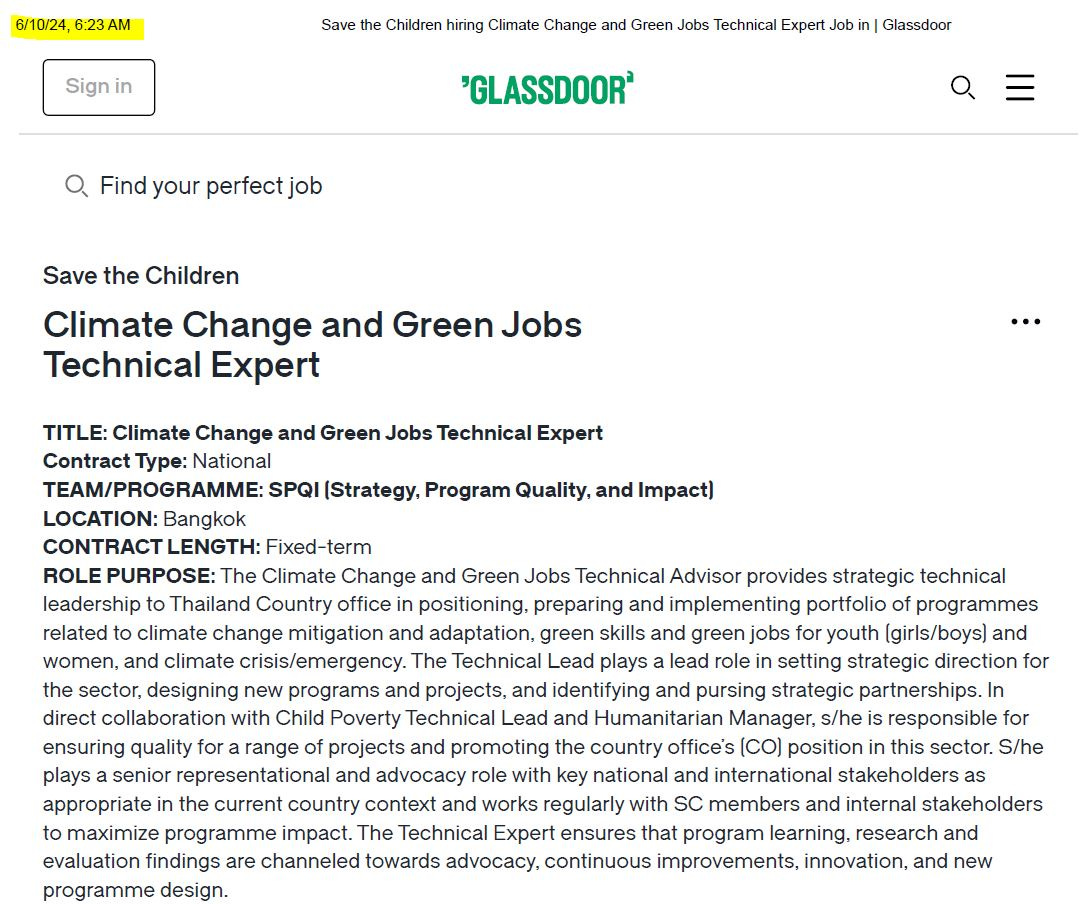

JOB POSTING

Check out this job posting by Save The Children on GlassDoor and let us attempt to translate it. The posting has since been taken down and unfortunately I did not preserve the link on the wayback machine in time. I saved it to PDF, which you can view in its entirety here:

We will look at the introduction of the posting:

Ulterior role purpose:

The Climate change and Green Jobs Technical Advisor provides strategic propagandised leadership to Thailand country office in implementing programs related to the climate alarmism Ponzi scam, brainwashing the youth (boys/girls) and convincing people there is an existential threat in the form of a ‘climate crisis’. The Technical lead must be able to lie with ease, perpetuate complete falsehoods, and be entirely morally bankrupt. Under the auspices of senior representation and advocacy for key stakeholders, the successful candidate will help to usher in a new era of technocratic enslavement for their fellow human beings, whilst receiving considerable remuneration. The Technical Expert ensures that the program’s efficacy is beyond reproach, helping to stifle any dissent, whilst engaging in continuous improvements and innovations and how to more efficiently Carbon tax the serfs, strip their assets, and support the financialisation of nature’s resources as an asset class.

MOTIVATIONS

The debate around the motivations behind carbon taxes and sustainable development goals can be complex and multifaceted -if we are to take them at face value. Here are some more details on the perspectives mentioned earlier:

Technocracy:

Technocracy refers to a political system where decision-making power is concentrated in the hands of experts and technocrats, often at the expense of democratic processes and individual input. Initiatives like carbon taxes and cap-and-trade systems can be a step towards a technocratic system, as they rely on data-driven decision-making and expert-led policies. This can lead to a lack of transparency and accountability, as well as a reduction in individual agency and decision-making power.

Control and Surveillance:

Carbon taxes can create a system of surveillance and control, where individuals and corporations are monitored and penalised for their environmental impact. This can be seen as a form of control, as it incentivizes certain behaviors and discourages others. For example, carbon taxes can make it more expensive for individuals and corporations to engage in environmentally damaging activities - which could be deemed as driving diesel and petrol fueled vehicles, for example. This tool can be seen as a form of control that restricts individual freedom.

Corporate Interests:

Carbon offsets and greenwashing can benefit corporations more than the environment, as they allow companies to continue business-as-usual practices while appearing environmentally friendly. This can be seen as a way for corporations to maintain their profit margins while appearing to address environmental concerns. Additionally, carbon markets and offsetting schemes can create new profit opportunities for corporations, while potentially benefiting from regulatory loopholes and lack of transparency.

Inequality and Exploitation:

The implementation of carbon taxes and other environmental policies will disproportionately affect the poorest in society, who will bear the brunt of these policies. Additionally, the focus on sustainable development goals and renewable energy can create new industries and job opportunities, but these will close down existing industries that we depend on and take for granted, making previous jobs redundant by executive fiat order - to meet insane carbon emission quotas.

Here at Creed Speech, we absolutely do not take any of the proclamations coming out of the climate cultists agenda at face value. We can explore their motivations to try and get inside the mindset of the useful idiots going along with the Carbon Tax Dystopia; the same captured mindset affecting the menticide-afflicted-masses.

As Eric Arthur Blair wrote so eloquently:

The Party seeks power entirely for its own sake. We are not interested in the good of others; we are interested solely in power. Not wealth or luxury or long life or happiness: only power, pure power. What pure power means you will understand presently. We are different from all the oligarchies of the past, in that we know what we are doing.

We know that no one ever seizes power with the intention of relinquishing it. Power is not a means, it is an end. One does not establish a dictatorship in order to safeguard a revolution; one makes the revolution in order to establish the dictatorship. The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?'

This is how the climate cultists want us to imagine our world if we do not comply and roll over for their carbon tax Ponzi and green washing of the economy. A wasteland of pollutants caused by “fossil fuels” - for which we actually sorely depend on to avoid mass famine, impoverishment, and death:

I hope that this piece has provided some valuable resources for the reader and for other researchers to use as a springboard to investigate further across other countries in South East Asia. Raising awareness and knowledge is a powerful persuader to lead people to see what we are sleepwalking into - as willing, compliant, subservient serfs in an unfathomable neofeudalistic landscape of mass control.

Nicholas Creed is a Bangkok based writer. All content is free for all readers, with nothing locked in archive that requires a paid subscription. Any support is greatly appreciated. If you are in a position to donate a virtual coffee or throw me some Bitcoin Sathoshis, it would mean the world of difference. Times are very hard.

Bitcoin address:

bc1p0eujhumczzeh06t40fn9lz6n6z72c5zrcy0are25dhwk7kew8hwq2tmyqj

Monero address:

86nUmkrzChrCS4v5j6g3dtWy6RZAAazfCPsC8QLt7cEndNhMpouzabBXFvhTVFH3u3UsA1yTCkDvwRyGQNnK74Q2AoJs6

There's a Dean Koontz novel in which a rich character is involved in "save Gaia" scams. I really wish I could remember which book it was or even what the plot had to do with, but here's the excerpt I kept from it:

“He held binding commitments from three tribes in remote parts of Africa, which required them to plant huge numbers of trees and to continue living without running water, electricity, and oil-powered vehicles. The environmental damage they didn’t do could then be sold to movie stars, rock musicians, and others who were committed to reducing pollution but who were required, by the nature of their professions, to have humongous carbon footprints. He also sold carbon offsets to himself through an elaborate structure of LLPs, LLCs, and trusts that afforded him tremendous tax advantages. Best of all, he didn’t have to share any of the carbon-offset income with the African tribes because they didn’t exist.”

I love that Blair quote. To that I will add this one:

"They do not want to own your fortune, they want you to lose it; they do not want to succeed, they want you to fail; they do not want to live, they want you to die; they desire nothing, they hate existence, and they keep running, each trying not to learn that the object of his hatred is himself... [They] seek, by devouring the world, to fill the selfless zero of their soul. It is not your wealth that they’re after. Theirs is a conspiracy against the mind, which means: against life and man."

I hadn't heard of "cacotopia" before, but I was familiar with "kakistocracy": Rule by the worst a society has to offer. Turns out that both terms have their root in the Greek "kakós," meaning "bad."

Thank you for sorting through that toxic sludge of climate scams. I don't know how you do it. Just reading it makes me want to stab people with a fork.